Identity Theft Tools & Tips

Defend your personal data and avoid falling victim.

Protect your identity, credit, and finances around the clock with the help of Allegiance.

Fight Back Against Identity Theft

Tools for Digital Banking Users

Fraud can happen fast, but with the right tools and tips, so can your response. Allegiance Credit Union is proud to help our members safeguard themselves from the unexpected. Identity theft protection isn't just enrolling in eStatements and Bill Pay to avoid mail fraud. Explore more tools and tricks to stay ahead of the fraudsters.

2/4 7 CREDIT MONITORING

MOBILE WALLET ACCESS

Leave your wallet at home! Add your debit and credit cards to your mobile wallet.DEBIT CARD CONTROLS

Lock and unlock your debit card if your card is lost or stolen inside Mobile Banking.ACCOUNT ALERTS

Set up real-time account alerts for large purchases, low balances, and more!/father-son-using-tablet.webp?width=1800&height=1800&name=father-son-using-tablet.webp)

Fraud Doesn’t Discriminate

From Students to Seniors, Identity Theft Hits Hard

Fraud can strike anyone, no matter their age, lifestyle, or income. Young adults are targeted for their clean credit, while seniors are targeted for their life savings. Even children can be victims before they’ve opened a bank account. Reporting fraud quickly can help you recover faster and get your finances back on track.

Timing Matters

How To Report Fraud (3 Steps)

Contact Creditors & Financial Institutions

Report The Crime

Report the crime and file a report with either your local police department or the police where the identity theft took place. Request a copy of the report. Create an Identity Theft Report with the Federal Trade Commission (FTC), which is the combination of the Identity Theft Affidavit, also filed with the FTC, and the police report.Obtain A Credit Report

/Earnie%20Shredding%20Papers.webp?width=1800&height=1800&name=Earnie%20Shredding%20Papers.webp)

Stay One Step Ahead

Tips to Avoid Identity Theft

Protecting your personal information starts with smart habits and a little vigilance. These tips will help you safeguard sensitive data, and reduce your risk of becoming a target.

1: Don't Leave Your Laptop, Wallet, or Smartphone Unattended or Unlocked

2: Use Password Protection

3: Think Twice About Public Wifi Connections

4: Shred Sensitive Documents

5: Only Carry What You Need In Your Wallet

6: Lookout for Email and Website Scams

Mobile Banking Tools

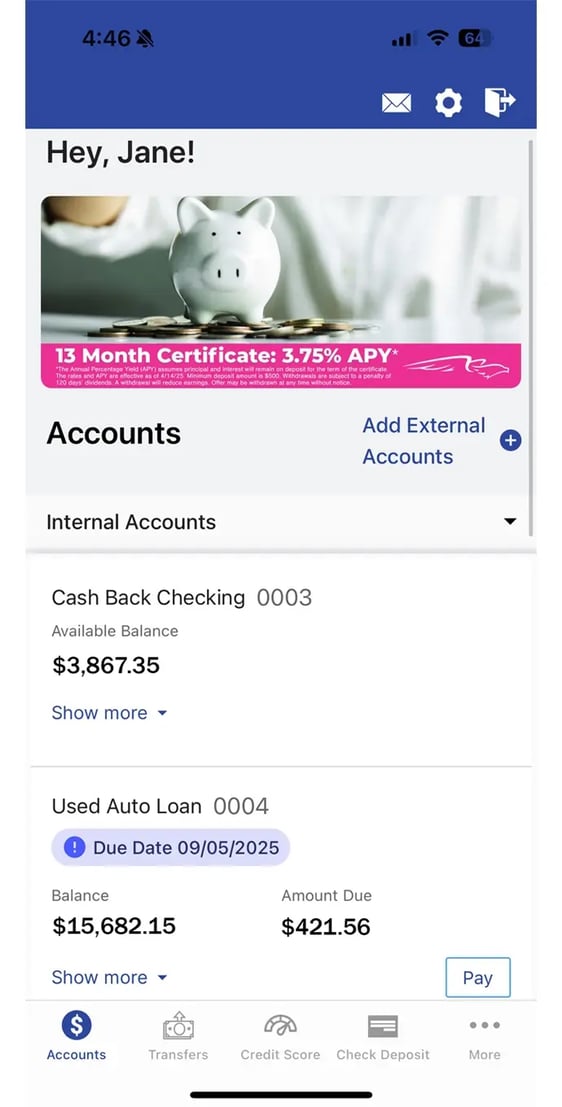

Whether you're at home in Oklahoma or traveling across the globe, the Allegiance Mobile Banking App puts powerful tools at your fingertips. Get real-time alerts, monitor your credit, turn off your debit card, and more with convenient access to your accounts anywhere, anytime.

-

-

Monitor Your Credit Report

Stay on top of your finances with free credit score monitoring. Access your credit report daily to spot changes early and see what impacts your score. It’s smart credit management for all who want to take control of their financial future.

-

-

Identity Theft & Fraud Protection Resources Just For You

6 Ways to Protect Against Business Fraud and Identity Theft

Incidents of business fraud and identity theft continue to rise, costing business owners time,...

Read More

Avoiding Identity Theft: Keeping Your Private Info Secure

In the past, people were concerned about protecting cash and jewelry from theft. However, nowadays,...

Read More

How to Protect Yourself From Credit Card Fraud

In the modern world, almost everyone holds a credit card. Reportedly, 7 in 10 American’s have at...

Read More