Allegiance Credit Union Membership

Join the best credit union in Oklahoma City!

Join a community that puts you first. At Allegiance Credit Union, we offer personalized service, better rates, and a commitment to your financial success.

Join a community that puts you first. At Allegiance Credit Union, we offer personalized service, better rates, and a commitment to your financial success.

At Allegiance Credit Union, membership means more than access to financial services, it means being part of something local, personal, and built around you. We’re proud to serve Greater Oklahoma City with member-first benefits designed to help you reach your financial goals.

We're only here because we have you to serve. Our employees and internal culture thrives on the success of our Oklahoma City friends, neighbors, and members.

Allegiance Credit Union membership is open to anyone who lives, works, worships, or attends school in the following Oklahoma counties:

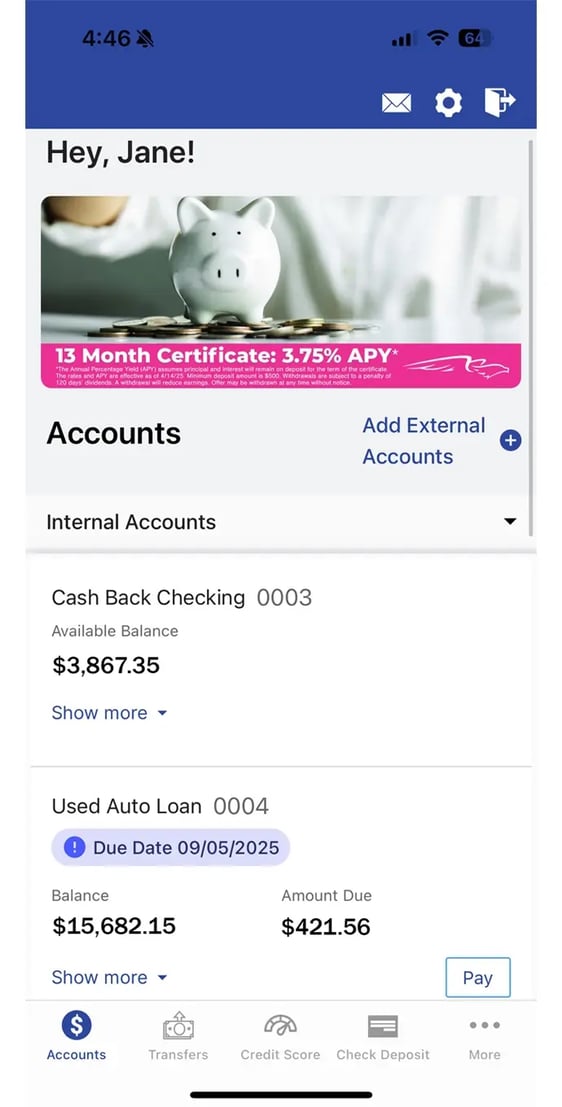

Whether you're at home in Oklahoma or traveling across the globe, the Allegiance Mobile Banking App puts powerful tools at your fingertips. Get real-time alerts, monitor your credit, turn off your debit card, and more with convenient access to your accounts anywhere, anytime.

Stay on top of your finances with free credit score monitoring. Access your credit report daily to spot changes early and see what impacts your score. It’s smart credit management for all who want to take control of their financial future.

“I always feel like they care when I am there. Thank you for always doing a great job!”

Sherri C.

"I feel like all of my interactions with ACU have been focused on my financial health and well-being as opposed to what my most benefit the credit union."

Kevin M.

To open an account you will need:

A government-issued, non-expired photo ID. If the address listed on the ID is not current, a document listing the current address is required. Generally, a utility or phone bill is acceptable.

For minor accounts, a social security card is required for the minor.

Allegiance Credit Union is proud to be an Accredited Business of the Better Business Bureau (BBB) of Central Oklahoma.