Online Banking

Seamless banking for all who don't have time to wait.

From the couch to your commute, Allegiance's Online Banking keeps you in control 24/7.

Skip The Trip

Online Banking Features & Benefits

Busy days don’t always leave time for branch visits, but managing your money shouldn’t have to wait. With secure, 24/7 access through Online Banking, Allegiance Credit Union members can take control of their finances from Oklahoma City or across the globe. Whether you're transferring money after hours or checking balances on the go, Allegiance makes it easy to bank on your schedule.

MONITOR CREDIT

MANAGE ACCOUNTS

Pay bills, monitor your account activity, and view eStatements, all with a few clicks.MAKE LOAN PAYMENTS

TRANSFER FUNDS

Shift your money between accounts and transfer funds in just a few taps.Explore our Mobile Banking App

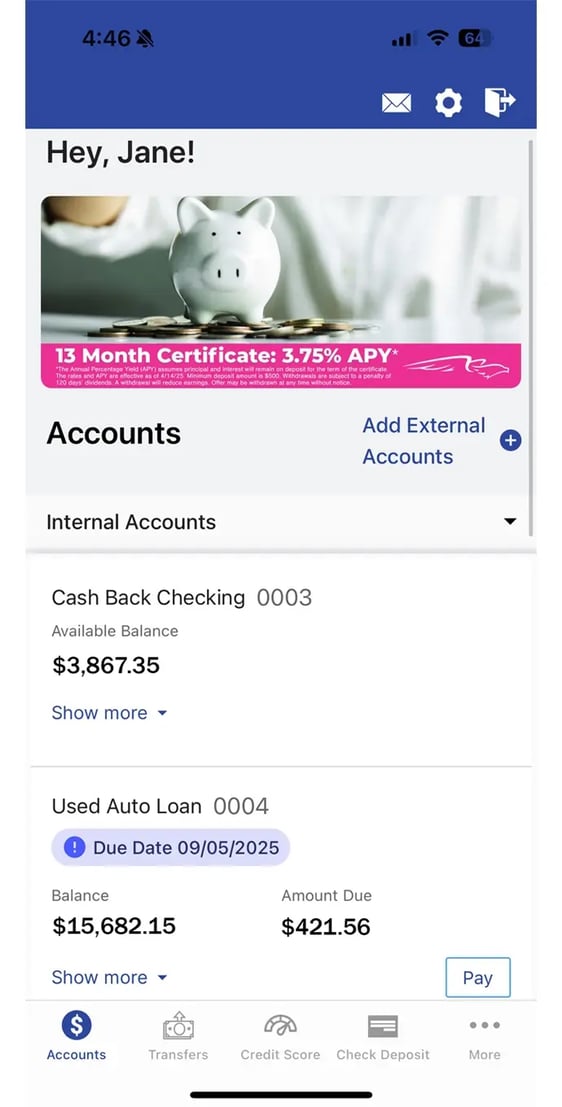

Whether you're at home in Oklahoma or traveling across the globe, the Allegiance Mobile Banking App puts powerful tools at your fingertips. Get real-time alerts, monitor your credit, turn off your debit card, and more with convenient access to your accounts anywhere, anytime.

-

-

Monitor Your Credit Report

Stay on top of your finances with free credit score monitoring. Access your credit report daily to spot changes early and see what impacts your score. It’s smart credit management for all who want to take control of their financial future.

-

-

What Is Bill Pay?

Bill Pay Benefits

Paying bills just got easier. With Bill Pay, you can schedule secure payments from your account and get back to what matters.

- First, sign in to your Allegiance Credit Union Online Banking Account.

- Once logged in, select "Bill Pay" from the Dashboard.

Worried about keeping your information safe? We have taken several steps to guarantee the safety of your information during internet transactions.

When you connect to our home banking site, you need a browser that complies to the SSL (Secure Socket Layer) specification, which is an accepted standard for digital encryption.

*When enrolling in Online Banking the primary account holder's info must be used and match what was given at account opening. When entering your date of birth (DOB) it is asking for DAY/MONTH/YEAR format of the primary account holder.

What Our Members Are Saying

"Long time member and I have always had great experiences with Allegiance CU!"

Andrew S.

"I’ve been with Allegiance since 2013 and have always had great experiences. Everything is easy and hassle free."

Debra S.

/Allegiance%20Mobile%20App_faceless.webp?width=1800&height=1800&name=Allegiance%20Mobile%20App_faceless.webp)

Cut The Clutter

eStatement Benefits

Easy. Secure. Instant. What’s not to love? Make the switch to eStatements and enjoy faster access to your account information and no more waiting on the mail.

Your statements are available anytime through Online Banking, where you can view, download, or print them whenever it’s convenient for you.

By going paperless, you’ll also help reduce the risk of mail-related identity theft and support a greener Oklahoma. To enroll, simply give us a call at 405-789-7900 Monday - Friday between 8:00 AM - 5:00 PM CT.

Frequently Asked Online Banking Questions

How do I set up Online Banking?

Please register here for online banking access. This can be completed on a desktop or via mobile device.How do I log in to Online Banking?

How do I view my mortgage in Online Banking?

How do I transfer funds between my accounts?

From the online banking homepage, go to the Transfers menu and click Make a Transfer. From there you can transfer between your ACU accounts.You can also transfer funds by going to the Account Summary widget and selecting the Transfer icon.