Home Equity Loans In OKC

For All Your Home's Possibilities

Turn built-up home equity into built-out plans.

Turn built-up home equity into built-out plans.

|

Mortgage Terms

|

APR* (as low as)

|

|---|---|

|

5 years

|

6.125%

|

|

10 years

|

6.250%

|

|

15 years

|

6.375%

|

*APR = Annual Percentage Rate.

**Max. LTV = Maximum Loan to Value. Final rate and term determined during underwriting.

Call for rates on terms 15 years and up.

Allegiance Credit Union’s Home Equity Loan gives Oklahoma homeowners a straightforward way to tap into their home’s equity with one of the more affordably priced loan options available. Enjoy a predictable monthly payment, fixed rate, and set loan payoff date. While the funds can be used for a variety of purposes, it is a great alternative to personal loans that typically carry higher rates and lower limits.

Make the most of your home’s equity with an Allegiance Credit Union Home Equity Loan. Get the funds you need upfront with no surprises so you can focus on bringing your vision to life, not worrying about your budget.

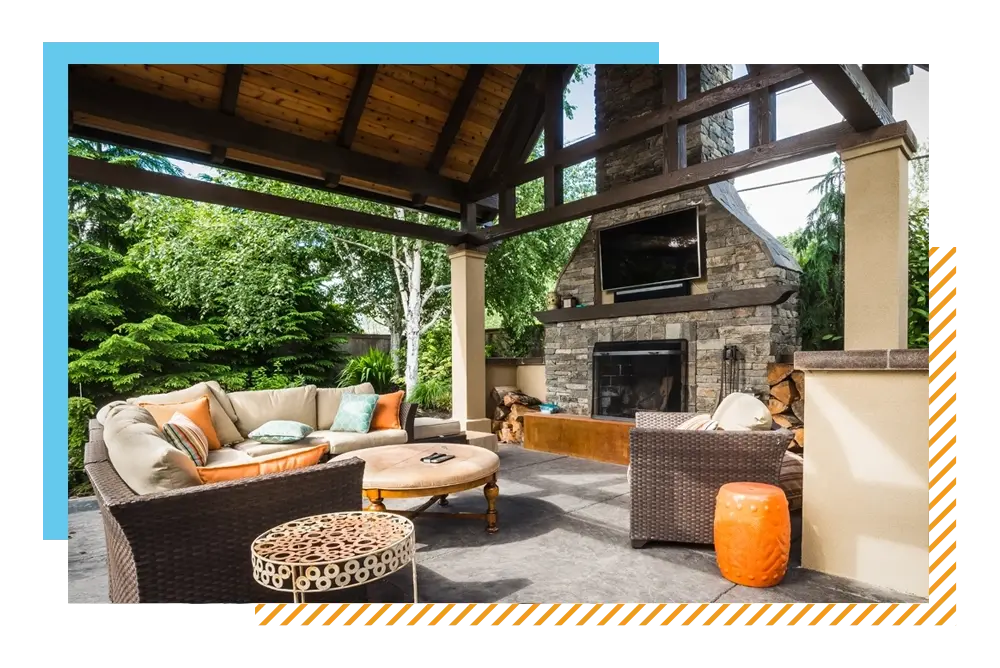

A Home Equity Loan is a smart, dependable way to fund major home improvements for your Oklahoma property. Whether you're remodeling your kitchen, adding a storm shelter, or making essential repairs, you'll receive your funds upfront—so you can start building right away with confidence.

Simplify your budget and reduce interest costs by consolidating high-interest debts into one lower consistent monthly payment. With a fixed rate and lump-sum funding, a Home Equity Loan helps you move forward with clarity and confidence.

Medical expenses can come suddenly and grow quickly. A Home Equity Loan from Allegiance Credit Union gives you a reliable way to cover healthcare costs (planned or unexpected) without the worry.

Life’s biggest milestones deserve to be celebrated. Whether you’re planning a dream wedding or a once-in-a-lifetime vacation, use the equity in your home to help make it possible.

From college tuition to private school fees, education is one of the most important investments you can make. A Home Equity Loan offers a flexible, cost-effective way to support your goals.

A Home Equity Loan is a smart, dependable way to fund major home improvements for your Oklahoma property. Whether you're remodeling your kitchen, adding a storm shelter, or making essential repairs, you'll receive your funds upfront—so you can start building right away with confidence.

Simplify your budget and reduce interest costs by consolidating high-interest debts into one lower consistent monthly payment. With a fixed rate and lump-sum funding, a Home Equity Loan helps you move forward with clarity and confidence.

Medical expenses can come suddenly and grow quickly. A Home Equity Loan from Allegiance Credit Union gives you a reliable way to cover healthcare costs (planned or unexpected) without the worry.

Life’s biggest milestones deserve to be celebrated. Whether you’re planning a dream wedding or a once-in-a-lifetime vacation, use the equity in your home to help make it possible.

From college tuition to private school fees, education is one of the most important investments you can make. A Home Equity Loan offers a flexible, cost-effective way to support your goals.

A Home Equity Loan is a smart, dependable way to fund major home improvements for your Oklahoma property. Whether you're remodeling your kitchen, adding a storm shelter, or making essential repairs, you'll receive your funds upfront—so you can start building right away with confidence.

Simplify your budget and reduce interest costs by consolidating high-interest debts into one lower consistent monthly payment. With a fixed rate and lump-sum funding, a Home Equity Loan helps you move forward with clarity and confidence.

Medical expenses can come suddenly and grow quickly. A Home Equity Loan from Allegiance Credit Union gives you a reliable way to cover healthcare costs (planned or unexpected) without the worry.

Life’s biggest milestones deserve to be celebrated. Whether you’re planning a dream wedding or a once-in-a-lifetime vacation, use the equity in your home to help make it possible.

From college tuition to private school fees, education is one of the most important investments you can make. A Home Equity Loan offers a flexible, cost-effective way to support your goals.

/medium-shot-roommates-with-laptop.webp?width=1800&height=1800&name=medium-shot-roommates-with-laptop.webp)

An Allegiance Credit Union Home Equity Loan lets you borrow up to 95% of your home’s value—based on your credit and debt-to-income ratio—at a fixed rate with predictable payments. Whether you're planning a major renovation, consolidating debt, or covering life’s big expenses, this loan gives you the freedom to use your funds however you need.

Looking for competitive Home Equity Loan rates in Oklahoma? Allegiance Credit Union is here to help you make the most of your home’s value. Questions? We can help! Contact our team to explore your options.

/Paperwork_Christin_MortgageSign.webp?width=1800&height=1800&name=Paperwork_Christin_MortgageSign.webp)

We’re proud to offer home equity solutions to all of our qualified Oklahoma members. Sometimes bank jargon can be confusing. To help clarify, a Home Equity Loan is a type of second mortgage, allowing you to access your home’s value without changing your primary mortgage terms. If your home is owned free and clear, a Home Equity Loan can also serve as your primary mortgage.

Second mortgages include both Home Equity Loans and Home Equity Lines of Credit (HELOCs), offering flexible ways to access funds for what matters most. ADD LINE ABOUT FIXED RATE VS REVOLVING VARIABLE RATE.

We’re here to help you understand your options and find the right fit! Contact us to learn more.

Curious how much a Home Equity Loan may impact your finances? Use Allegiance Credit Union's Home Equity Loan calculator to explore different loan amounts, interest rates, and terms to find the best option that fits your monthly budget.

*Your actual term and payment will be provided upon acceptance of an Allegiance Credit Union loan. This calculator is for informational purposes only and its use does not guarantee an extension of credit.

Discover how a Home Equity Loan, Home Equity Line of Credit, and Quick Cash Home Improvement Loan compare.

“What a awesome bank! Been there about 5 months. They have a new feature it's called Quick Cash Loan - big loan with low monthly payments, no credit check. I highly recommend them.”

Robert R.

“Great experience! They are very pleasant and knowledgeable. I'm moving all my banking here! Thank you Allegiance for the excellent service!”

Lori P.

Securing a debt consolidation loan and paying down your obligation can fast-track you to an...

Read More

If you're a homeowner, a smart money move is thinking creatively about leveraging your home’s...

Read More

Working families need to make money management decisions that maximize their cash-on-hand resources...

Read More