Debit Card Dispute

Unexpected Charge? Let’s Make It Right.

If you notice an incorrect charge on your Allegiance statement, report it immediately and get your money back where it belongs.

/person-doing-day-day-activity-while-waring-string-finger-remember-something-important.webp?width=1800&height=1800&name=person-doing-day-day-activity-while-waring-string-finger-remember-something-important.webp)

Let's Fix This Together

Debit Card Fraud and Billing Disputes

If you suspect an issue with a debit card transaction, whether it's a billing error or a problem with a purchase, please contact us immediately.

- Please call us at 405-789-7900 as soon as possible.

- If after hours or on weekends, call 1-888-263-3370.

We will help resolve the issues and will get you a new debit card if necessary as soon as possible.

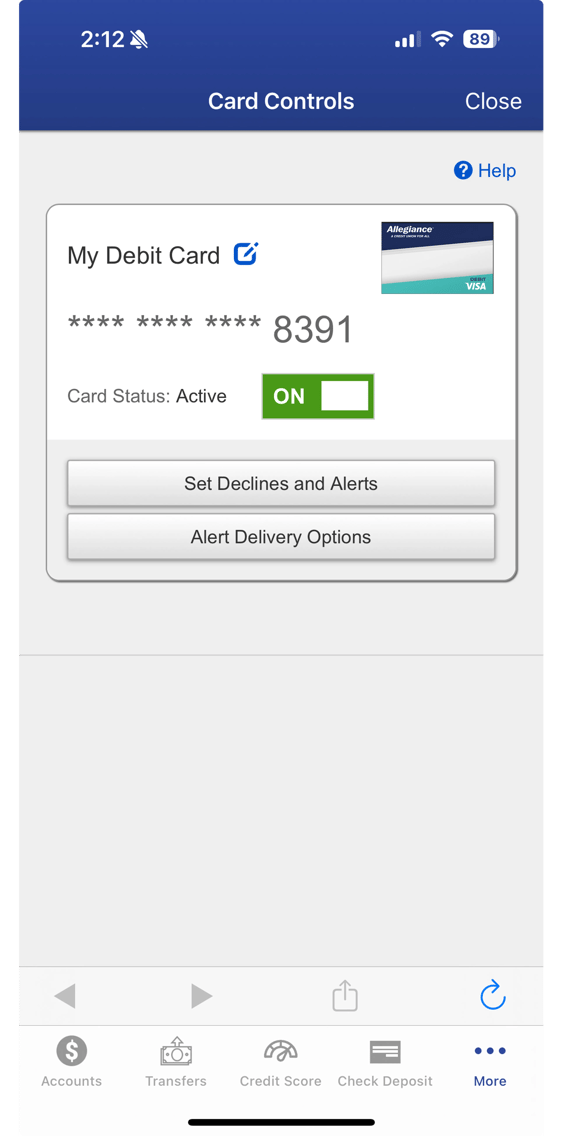

Card Controls Keep Your Money Safe

Take control fast. Use the Allegiance Credit Union Mobile App to lock your Debit or Credit Card and help prevent further fraud while we investigate any suspicious charge(s).

-

Lock Your Debit Card

If you see a charge you don’t recognize on your Allegiance Credit Union eStatement, use our Mobile App to lock your debit card while we investigate the activity. Don't worry, once we clarify the charge you can easily unlock your card as long as a new card isn't required.

-

Create Custom Alerts

Stay on top of your finances! Set balance and deposit/withdrawal notifications inside online banking and mobile banking so you can stay on top of big transactions and purchases.

You can even set alerts for debit card transactions at certain merchants. Alerts can be set for both email and text messages.

What Are Some Things You Can Do To Help Prevent Debit Card Fraud?

/Paperwork_couple%20studying%20statements.webp?width=1800&height=1800&name=Paperwork_couple%20studying%20statements.webp)

1. Use Account Alerts

Set up transaction and balance alerts through our Mobile Banking App to get real-time notifications. This helps you spot unauthorized charges right away.

2. Monitor Your Account Regularly

Review your statements and transaction history frequently. The sooner you spot suspicious activity, the faster you can report and resolve it.

3. Use Secure Networks When Banking

Avoid accessing your bank account or making purchases over public Wi-Fi. Use trusted, password-protected networks to reduce exposure to hackers.

4. Report Your Card Missing Fast, Don't Delay

Quickly reporting your card as missing or stolen will help you prevent additional fraud.

/focused-african-american-guy-talking-cell-looking-tablet-screen.webp?width=1800&height=1800&name=focused-african-american-guy-talking-cell-looking-tablet-screen.webp)

Fighting Fraud Together

Credit Card Fraud and Billing Dispute

If you suspect an issue with a credit card transaction, whether it's a billing error or a problem with a purchase, please contact us immediately.

- Please call 1-800-558-3424.

- For hearing impaired members, call our TTD line at 1-888-352-6455.

- If you are outside the U.S. call 701-461-1556 COLLECT.

We'll help you resolve the issues and will get you a new credit card if necessary as soon as possible.

What Our Members Are Saying

“This is my first year of banking with Allegiance Credit Union, and all of my problems have been solved in a timely fashion.”

Emme L.

“Always helpful and pleasant to work with.”

Kelly M.

Additional Resources

6 Ways to Protect Against Business Fraud and Identity Theft

Incidents of business fraud and identity theft continue to rise, costing business owners time,...

Read More

Avoiding Identity Theft: Keeping Your Private Info Secure

In the past, people were concerned about protecting cash and jewelry from theft. However, nowadays,...

Read More

How to Protect Yourself From Credit Card Fraud

In the modern world, almost everyone holds a credit card. Reportedly, 7 in 10 American’s have at...

Read More