Most individuals understand the importance of having a good checking account with a financial institution they can trust. They also know that not all checking accounts are created equally, so doing your homework is crucial for finding the perfect fit for your financial needs. If you want to bank like a boss, you should consider Allegiance versus a national bank for the best checking account, no matter your situation.

Why a Credit Union Checking Account?

Credit unions are a wonderful option for anyone who wants to open the best checking account that offers generous benefits to their members, including these:

Benefits of a Credit Union Checking Account:

-

Lower Fees

-

Fewer Minimum Requirements

-

Better Rewards

-

Superior Personal Customer Service

-

Deposits are insured by the National Credit Union Administration (NCUA) up to $250,000

Your local credit union is here to support the financial journey of all members. Whether you are just starting out, reorganizing your finances, or progressing well on your financial path, Allegiance offers a variety of different checking account options to fit your unique situation.

Tailored Checking Options at Allegiance

Allegiance offers a variety of diverse checking accounts for members, including the following:

- CASH BACK Checking Account - If you want to earn cash back by swiping your debit card, the CASH BACK Checking Account is what you’re looking for! Plus, no monthly maintenance fee or penalties for not qualifying.

-

CASH Checking Account- If earning interest on your account balance is your goal, the CASH Checking Account is for you! Plus, no monthly maintenance fee or penalties for not qualifying.

- Second Chance Checking - If you need a second chance to show your money skills, this account is the best choice.

Choosing the Right Checking Account

Savvy individuals can utilize their checking accounts for daily financial management and savings if they choose the right one. When searching for the best checking account to fit your needs and help meet your financial goals, these are some key features to consider.

-

No or Low Fees

-

No Minimum Balance Requirements

-

Online and Mobile Banking Options

-

Benefit of Earning Dividends

Enhancing Your Checking Experience with Complementary Services

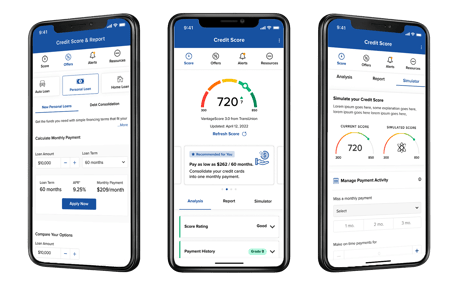

Since we are a technology-driven culture, having complementary digital banking options with a checking account is a definite plus. Allegiance offers a variety of digital services to meet members’ high-tech needs and stay connected from anywhere, anytime.

-

Digital Banking – Enjoy the convenience of Online and Mobile banking at your fingertips for tasks such as managing your checking account, transferring money, monitoring your credit score, paying bills, and more.

-

Mobile Wallet Integration - For seamless transactions every time you shop, use the convenient Mobile Wallet so you can securely make purchases from your phone.

-

Direct Deposit Services – Allegiance's direct deposit service is a simple and secure way to deposit any recurring check, like your weekly paycheck, into your account without the need to visit the bank. Plus, because Allegiance processes items from the Federal Reserve as soon as they receive them, your direct deposit can potentially get your paycheck into your checking account up to two days early.

Allegiance: Empowering Your Financial Journey

Selecting the right checking account is a critical step for effective financial management, particularly for the tech-savvy individual. It's about more than just a place to store your money. The ideal account offers low fees, easy access via online and mobile platforms, the potential for dividends, and integrates seamlessly with digital services like mobile wallets and direct deposit. Allegiance's suite of digital banking solutions highlights the importance of a checking account that fits your modern lifestyle and financial ambitions. By focusing on these essentials, you position yourself for a future of financial ease and security. Make the smart choice today for a prosperous tomorrow.